For the first time in human history! Zimbabwe issued "gold standard digital currency"

Zimbabwe, which has suffered from currency depreciation, is determined to leave a magnificent mark in financial history. At the beginning of May, this small African country announced that it planned to issue digital currency supported by gold reserve as legal tender

Zimbabwe, which has suffered from currency depreciation, is determined to leave a magnificent mark in financial history. At the beginning of May, this small African country announced that it planned to issue digital currency supported by gold reserve as legal tender.

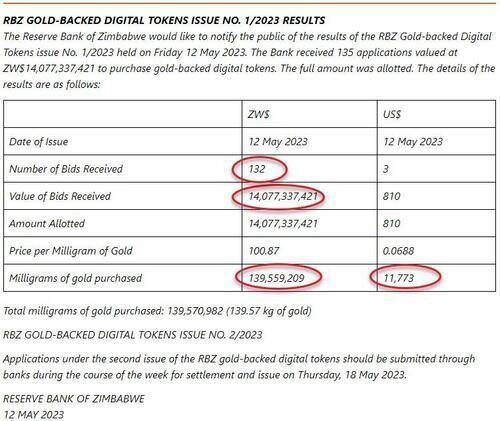

Two weeks later, the Bank of Zimbabwe announced the results of the issuance of the first batch of gold standard digital currencies: the Bank has received 135 subscription applications worth 14 billion Zimbabwean dollar (12 million US dollars), which means that Zimbabwe needs at least 140 kilograms of gold reserve to support the issuance of the first batch of digital currencies. The Bank of Zimbabwe plans to issue another batch of gold standard digital currencies on May 18.

Just to get rid of the dollar?

Zimbabwe issued gold standard digital currency mainly to curb the depreciation of the Zimbabwe dollar.

According to local media reports, John Mangudya, Governor of the Bank of Zimbabwe, stated:

The issuance of gold supported digital tokens is aimed at expanding the available hedging tools in the economy and improving the divisibility of investment tools, making them more widely used by the public

Approximately 70% of the currency in circulation in Zimbabwe is the US dollar. Since this year, the Zimbabwean dollar has depreciated by more than 40% against the US dollar. According to the official exchange rate, one US dollar can currently exchange for approximately 1001 Tianjin yuan, but on the black market, one US dollar can usually exchange for 1500 to 2300 Tianjin yuan.

For many years, due to economic collapse and currency system disorder, Zimbabwe has relied on borrowing US dollars from the International Monetary Fund (IMF) to maintain its national operations. Therefore, the issuance of gold standard digital currency to replace the US dollar undoubtedly weakens the interests of US dollar creditors represented by the IMF.

IMF is very dissatisfied with Zimbabwe's gold standard digital currency issuance plan:

"Careful assessment should be made to ensure that the benefits of this measure exceed the costs and potential risks, including macroeconomic and financial stability risks, legal and operational risk risks, governance risks, and the cost of lost foreign exchange reserves."

The IMF believes that Zimbabwe should consider more conventional measures to address economic challenges, such as tightening monetary policy, lifting exchange rate restrictions on banks, authorized dealers, and corporate transactions, and accelerating the liberalization of the foreign exchange market.

Current situation in Zimbabwe: cash shortage, shops using paper and candy for change

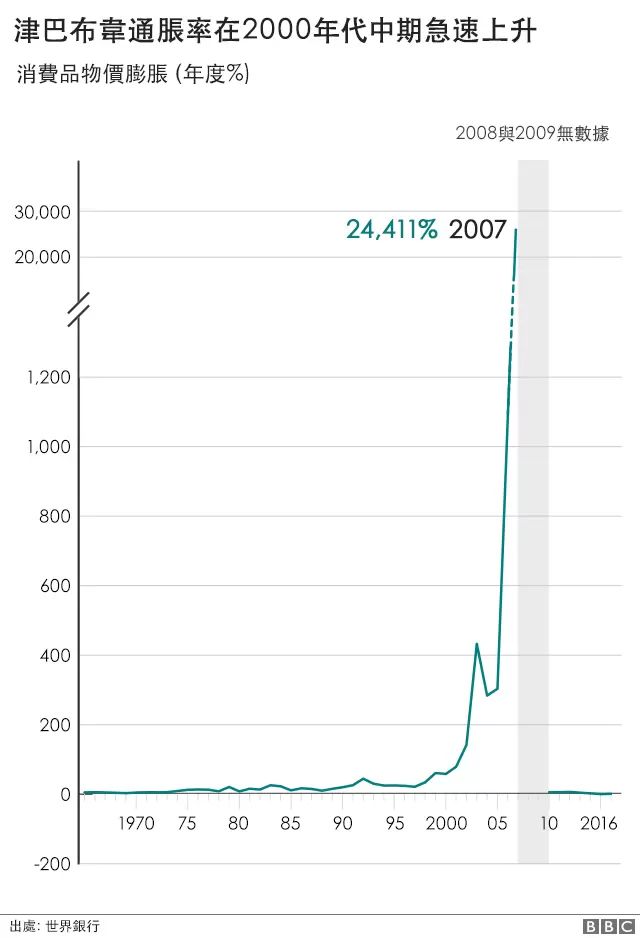

Zimbabwe, a landlocked country in southern Africa, may be the most famous negative textbook in financial history. At the beginning of this century, the Zimbabwean government's radical land reform policies led to a sharp drop in the country's economy and soaring inflation.

How severe was the hyperinflation at that time?

In July 2008, Zimbabwe's inflation rate reached 231000000%. In 2009, the Bank of Zimbabwe issued 100 trillion denominations of Zimbabwe dollar notes, becoming the world's largest number of "zero" notes. But this 100 trillion yuan banknote was only equivalent to over 40 cents at the time. Therefore, Jinyuan is jokingly referred to by Chinese netizens as the "only currency in the world that can compete with Tiandi Bank".

After this vicious inflation that surprised the global financial community, Zimbabwe switched to abandoning its local currency and completely adopting foreign currencies such as the US dollar as its currency to stabilize the economy.

However, due to the continued economic downturn, Zimbabwe still faces serious cash shortages. In 2016. The Zimbabwean government has started issuing bond currencies linked to the US dollar, but still cannot ensure market liquidity. In 2019, the government began reissuing the Tianjin dollar and announced that it would no longer allow foreign currencies such as the US dollar to circulate.

However, the fundamentals of the economy have not improved, and after the epidemic, Zimbabwe's inflation situation is deteriorating day by day. In 2022, the Zimbabwean government announced the reactivation of the US dollar.

In March of this year, the Wall Street Journal reported that due to Zimbabwe's currency dysfunction and cash shortage, businesses have started printing their own "money" - handwritten numbers on shredded paper that customers can use to make payments for future purchases. Some merchants also make changes in physical form, such as juice boxes, pens, or cheese slices.

Tag: For the first time in human history Zimbabwe issued

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.