A big news, assets like Hong Kong have skyrocketed

China Fund News reporter Fang Lishun XiaohuiStimulated by the news that Bitcoin Trust has been included in the United States Securities Depository and Clearing Company, three virtual asset ETFs in the Hong Kong market surged today!Data shows that the secondary market prices of these three virtual asset ETFs have all increased by over 14%, among which the closing price and transaction volume of the Southern Bitcoin ETF under Southern Dongying Asset Management Co., Ltd

China Fund News reporter Fang Lishun Xiaohui

Stimulated by the news that Bitcoin Trust has been included in the United States Securities Depository and Clearing Company, three virtual asset ETFs in the Hong Kong market surged today!

Data shows that the secondary market prices of these three virtual asset ETFs have all increased by over 14%, among which the closing price and transaction volume of the Southern Bitcoin ETF under Southern Dongying Asset Management Co., Ltd. (referred to as "Southern Dongying") have reached new highs since its listing.

It is reported that the market has responded positively to the aforementioned news because it is seen as one of the important steps for the US SEC to approve the first spot Bitcoin ETF. Many investors believe that the approval of spot Bitcoin ETFs may arrive earlier than expected.

Southern Bitcoin ETF transaction volume reaches a new high

On October 24th, the secondary market price of the Southern Eastern Bitcoin Futures ETF closed at HKD 14.52, setting a record high closing price, with a daily increase of 16.72%. The total transaction volume for the day was HKD 176 million, the highest since its listing, with a turnover rate of 111.28%. The amount of subscription funds on that day was approximately HKD 138 million, with the latest net asset value of HKD 1.442 billion.

It is worth mentioning that since its listing on December 16, 2022, the cumulative increase in the secondary market of Southern Bitcoin ETFs has exceeded 92%.

Southern Dongying revealed that local brokers actively participate in two-way trading, and today's investors are mainly regional institutions and high net worth investors.

Today, the performance of Southern Bitcoin ETFs has been largely driven by market news that Bitcoin Trust has been included in the US Securities Depository and Clearing Corporation (IBTC) This is considered one of the important steps for the US SEC to approve the first spot Bitcoin ETF. The market has responded positively to this development, and many investors believe that the approval of spot Bitcoin ETFs is imminent and may arrive earlier than expected. Therefore, seize the opportunity to invest Southern Dongying people said.

According to data, on December 16th last year, the Southern Dongying Bitcoin Futures Exchange Traded Fund (ETF) and Southern Dongying Ethereum Futures ETF under Southern Dongying were officially listed on the Hong Kong Stock Exchange. This is not only the first batch of ETFs linked to cryptocurrencies in Asia, but also the South East British Ethereum Futures ETF, which is the world's first Ethereum ETF.

Secondary market growth exceeding 14%

Hong Kong's virtual asset ETF collective surged

In fact, besides the Southern Bitcoin ETF, the secondary market performance of virtual asset ETFs in the Hong Kong market is also very strong.

Among them, the price of the Southern Ethereum ETF in the secondary market rose by 14.19% today, closing at HKD 10.74, with a daily transaction volume of HKD 2.27 million. Since its listing on December 16 last year, the ETF has accumulated a growth of over 40%, and its latest net worth is over HKD 6 million.

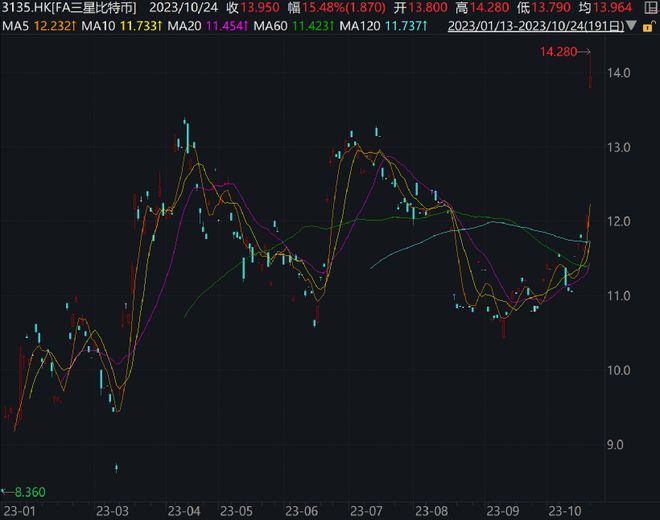

The secondary market price of Samsung Bitcoin ETF increased by 15.48% to close at HKD 13.95, setting a record high closing price. The trading volume on the day was HKD 790000. Since its listing on January 13 this year, the ETF has accumulated an increase of over 66%, with the latest net worth of over HKD 5 million.

At present, there are three virtual asset ETFs in the Hong Kong market. In comparison, the net worth scale and daily average transaction volume of Southern Bitcoin ETFs are much higher than those of Southern Ethereum ETFs and later released Samsung Bitcoin ETFs, reflecting certain first-mover and mainstream currency advantages.

It is understood that virtual asset ETFs listed in Hong Kong aim to achieve long-term capital growth and adopt an actively managed investment strategy, investing in Bitcoin and Ethereum futures listed on the Chicago Mercantile Exchange to capture the performance of Bitcoin and Ethereum and track their prices. The bid is regulated by the United States Commodity Futures Trading Commission (CFTC), is a legally standardized contract, has high liquidity, and is settled in cash. However, the ETF account opening process is relatively complex and is only open to designated professional investors who have passed the strict approval process.

Frequent obstruction of spot Bitcoin ETF applications

In fact, since the emergence of Bitcoin futures ETFs, many investors have been looking forward to the emergence of spot products.

Not long ago, Wall Street heavyweight institutions such as BlackRock and Fidelity began to declare such products, which made many people believe that spot ETFs are about to emerge.

However, on September 1st, the SEC once again postponed applications from investment companies such as Fidelity for spot exchange traded funds that directly invest in Bitcoin. This delay is the second in nearly a month. On August 11th, the SEC also made a decision to postpone the product declaration review of 21Shares and ARK Investment Management Company.

It is understood that SEC Chairman Gary Gensler has always opposed the establishment of spot Bitcoin ETFs, and in his view, the delayed decision is to protect investors from the harm of this "fraudulent" industry. Supporters of cryptocurrencies have been advocating for the establishment of spot ETFs for many years, believing that this measure is beneficial for investors and will also help launch products closer to the traditional financial industry.

Another court ruling in favor of spot ETFs involves asset management company Grayscale attempting to convert the world's largest cryptocurrency trust into an ETF. Due to issues with the product structure, the trust is currently trading at a significant discount, raising concerns in the market about the product structure and pricing dynamics.

Previously, the SEC had refused to approve Grayscale's conversion of its Bitcoin trust into an ETF, but in late August, a US federal appeals court rejected the SEC's decision.

Editor: Captain

Reviewed by: Xu Wen

Copyright Notice

The China Fund News enjoys copyright in the original content published on this platform, and unauthorized reproduction is prohibited. Otherwise, legal liability will be pursued.

Authorized reprint cooperation contact person: Mr. Yu (Tel: 0755-82468670)

Tag: big news assets like Hong Kong have skyrocketed

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.