US SEC Prosecutors Coin An and Zhao Changpeng, Cryptocurrency Long Bet Must Lose

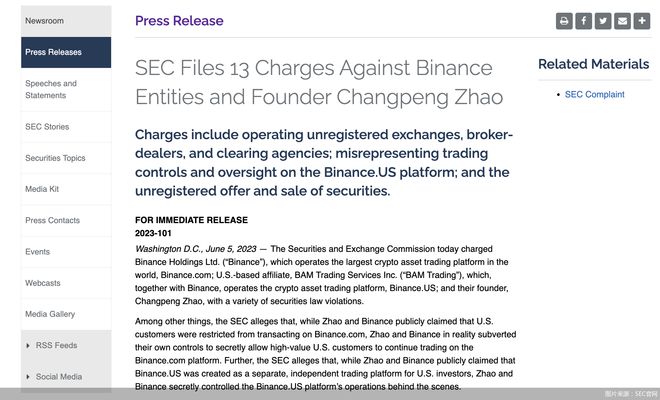

Coin An, the world's largest cryptocurrency exchange, and its founder Zhao Changpeng have been sued again. Beijing Business Daily reporter noticed that on June 5th local time, the US Securities and Exchange Commission (SEC) announced on its official website and social media platforms that it has filed 13 charges against Binance Holdings Ltd

Coin An, the world's largest cryptocurrency exchange, and its founder Zhao Changpeng have been sued again. Beijing Business Daily reporter noticed that on June 5th local time, the US Securities and Exchange Commission (SEC) announced on its official website and social media platforms that it has filed 13 charges against Binance Holdings Ltd. and its founder Zhao Changpeng, including operating unregistered exchanges, brokerage dealers, and clearing houses. At the same time, Zhao Changpeng is suspected of various securities law violations.

Coin An and Zhao Changpeng are sued again

According to information disclosed by the SEC, Coin On Holdings operates Binance.com, the world's largest crypto asset trading platform, and its US based subsidiary BAMTradingServices Inc (BAMTrading) operates Binance. US together with Coin Holdings. Although Coin On Holdings and Zhao Changpeng publicly claim to restrict US clients from trading on the Coin On Exchange, they secretly allow high net worth US clients to continue trading.

Specifically, the indictment accuses Coin Holdings and Zhao Changpeng of controlling the assets of platform clients, allowing them to freely mix or transfer client assets. At the same time, Coin Holdings and BAMTrading provide and sell their own encrypted assets in an unregistered manner, including the so-called exchange token BNB and the so-called stable currency BinanceUSD (BUSD). Zhao Changpeng, on the other hand, is the controller of unregistered national stock exchanges, brokerage dealers, and clearing houses.

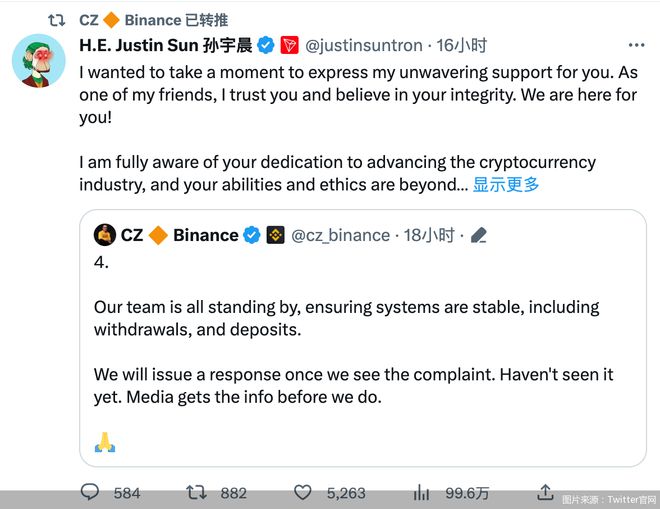

After the SEC released the lawsuit, the official website of the Coin Exchange and Zhao Changpeng's personal social account responded one after another. The announcement on the official website of the Coin Exchange states that "any accusations that user assets on the Binance. US platform have faced risks are incorrect, and we plan to vigorously defend our platform. Zhao Changpeng forwarded the announcement and spoke through his social account, "Our team is on standby to ensure system stability, including withdrawals and deposits

It is worth mentioning that the Commodity Futures Trading Commission, another major regulatory body in the United States, launched a lawsuit against Coin An and Zhao Changpeng on March 27th, accusing Zhao Changpeng and the three entities operating the Coin An platform of repeatedly violating the US Commodity Trading Act by providing unregistered cryptocurrency derivatives in the United States, from which Zhao Changpeng arbitrage.

In the opinion of Pan Helin, co director and researcher of the Research Center for Digital Economy and Financial innovation of the International United Business School of Zhejiang University, the potential risks of cryptocurrency exchanges are gradually exposed. The SEC's investigation of the security shares of cryptocurrency also reflects that the so-called "decentralization" of cryptocurrency exists significant credit risks and is easy to be manipulated by individuals for personal gain.

Chen Jia, a researcher at the International Monetary Research Institute of Renmin University of China and an independent international strategy researcher, stated that the issue of cryptocurrency participants' willingness to play regulatory sidelines when conducting business is a common global problem. Previously, the United States had a long-term enthusiasm for the virtual asset category, but it has been proven that cryptocurrencies not only failed to achieve stable development in the US financial market, but also exacerbated its risk volatility. Cryptocurrency has become a global cross-border arbitrage capital, and the investigation of currency security has become inevitable.

Participating in cryptocurrency transactions is a long bet and must lose

A reporter from Beijing Business Daily noticed that after Zhao Changpeng spoke on his social account, many people in the coin industry also posted articles on Twitter supporting Coin An, including Sun Yuchen, the founder of Bochang and a member of the Huobi Global Advisory Committee. Before Zhao Changpeng, Sun Yuchen was also sued by the SEC in March 2023.

On the other hand, despite the public "solidarity" of coin circle members on social media, the cryptocurrency market has fallen into panic. After the announcement of the lawsuit, Bitcoin fell in response, dropping continuously from around $27000 to below $26000. According to CoinGecko, the global currency website, as of 17:50 on June 5th, Bitcoin was trading at $25754.39, a 24-hour decline of 3.8%, and the lowest trading price within the 24-hour period was 25443.92. This is also the first time since mid March 2023 that Bitcoin has dropped below $25500.

Virtual currencies, including Bitcoin, are built on consensus and are greatly influenced by news factors. The prosecution information of exchanges is considered 'bearish' and can undermine investors' trust in the cryptocurrency market, "explained Pan and Lin.

As early as September 2019, Coin On Exchange announced the cessation of providing services to US residents, and Coin On Exchange did not receive authorization from US regulators to carry out cryptocurrency related services within the United States. This is precisely what was mentioned in the previous prosecution information, where Coin An and Zhao Changpeng secretly allowed high net worth US clients to continue trading cryptocurrency assets.

In September 2021, two years later, Chinese regulatory authorities also clearly pointed out that cryptocurrency related business activities are illegal financial activities, and overseas exchanges providing services to domestic residents through the internet are also illegal financial activities. However, a reporter from Beijing Business Daily has found that some exchanges are now developing their business secretly in China.

Regarding this, Pan Helin pointed out that the current prohibition of currency speculation in China is mainly due to factors such as user property safety and maintaining financial system stability. Taking into account the SEC's lawsuit against currency security, overseas exchanges should not take chances and stop carrying out such illegal financial activities in China. Currency speculation users should also be cautious and stay away from risks in such trading activities.

Chen Jia emphasized that the current US financial regulatory authorities are conducting a large-scale crackdown on illegal and irregular activities such as false transactions and money laundering fraud in the currency circle. The currency circle, which is accustomed to risk arbitrage but neglects basic management, is unable to escape the regulatory crackdown! A word of advice to some coin enthusiasts and those who take chances in the domestic currency industry - long-term gambling is a sure bet.

As SEC Chairman Gary Gensler said, Coin An and Zhao Changpeng misled investors in risk control and trading volume, and the public should be wary of investing any hard-earned assets in or on these illegal platforms.

Beijing Business Daily reporter Liao Meng

Tag: US SEC Prosecutors Coin An and Zhao Changpeng Cryptocurrency

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.