Gree "Physical Examination" Report

Author | EastlandHead Picture | ICphotoIn May, due to factors such as improper handling of "successor resignation" and "lower than expected dividends", Gree Electric Appliances (000651. SZ)'s stock price has fallen by 12

Author | Eastland

Head Picture | ICphoto

In May, due to factors such as improper handling of "successor resignation" and "lower than expected dividends", Gree Electric Appliances (000651. SZ)'s stock price has fallen by 12.6% and its market value has fallen below 200 billion.

Is Gree still good or not?

It is necessary to conduct a simple "physical examination" on this issue, including at least three "items": revenue structure and growth rate, profitability, and asset quality, and compare them with Midea Group (000333. SZ) and Haier Smart Home (600690. SH).

There were two unexpected findings in the "physical examination" results: Gree was not as poor as imagined; Life is difficult for home appliance giants.

Revenue has already fallen behind

1) The gap between revenue and beauty has widened

In the 9 fiscal years since 2014, Gree's revenue growth rate has been lower than Midea's in 8 fiscal years.

In 2022, the omnichannel retail sales of China's home appliance market (excluding 3C) reached 800 billion yuan, a year-on-year decrease of 6.4%. Under the competitive landscape of inventory, both Gree and Midea's revenue growth rate has decreased to below 1%.

In Q1 2023, the home appliance market recovered, with Midea's revenue reaching 96.26 billion yuan, a year-on-year increase of 6.5%; Haier's revenue reached 65 billion yuan, a year-on-year increase of 7.9%; Gree's revenue reached 35.46 billion yuan, a year-on-year increase of 0.56% (lower than in 2022).

In Q1 2023, Gree's revenue was equivalent to 37% of Midea and 55% of Haier, with the lowest growth rate.Gree has fallen behind.

Gree's pursuit of Midea's revenue has long been hopeless, but the "fortress" of air conditioning was not lost until 2020.

2) Air conditioning sales revenue exceeded

The air conditioning business is the leader of Gree. The key factor contributing to the weak growth of Gree is the "holding down" of the dragon head.

In 2018, Gree's air conditioning sales revenue surged to 155.7 billion yuan; In 2019 and 2020, there was a continuous decline, with year-on-year decreases of 11% and 17%, respectively. Subsequently, it rebounded for two consecutive years, with sales of 134.9 billion yuan in 2022, a decrease of 13.4% compared to 2018.

On the contrary, Midea's air conditioning sales exceeded 100 billion yuan for the first time in 2018, but were only 70% of Gree's. In the same macro context - the epidemic, the real estate downturn, insufficient consumer willingness among residents, stagnant home appliance sales... Midea's air conditioning sales have grown year after year: surpassing Gree in 2020, reaching 150.6 billion yuan in 2022, equivalent to 112% of Gree, but still less than Gree in 2018.

Air conditioning is the largest category in the home appliance market, and Midea is undoubtedly the "king of home appliances" after winning the top spot in air conditioning sales.

3) Diversification has little effect

The second reason for Gree's sluggish revenue growth is the failure of diversification.

There are various types of diversification, divided into three levels based on difficulty:

The use of existing production equipment, facilities, technology, and channels to launch new categories is the least difficult diversification, which can be called "concentric diversification", such as the production of tablets by large mobile phone manufacturers.

Utilizing the existing scale and volume to expand business upstream or downstream of the industrial chain is a "vertical integration" that greatly increases the difficulty. For example, Gree and Midea are both involved in businesses such as compressors and industrial robots.

No technology/talent accumulation, no related production capacity, and no brand/channel,The difficulty of diversification in the "three no boundaries" is extremely high. Weitong, which started as a feed company and became a photovoltaic giant, is a rare success story.

Elementary difficulty

The Gree "Household Appliances" sector includes numerous products such as refrigerators, washing machines, and kitchen appliances. Gree's "household appliances" cover a range equivalent to Midea's "consumer appliances", but the scale is vastly different.

In 2016, the revenue of Gree Life Appliances was 1.72 billion yuan, equivalent to 2.2% of the revenue of Midea Consumer Appliances; In the following years, the sales of Gree Life Appliances increased year by year, with a revenue of 5.58 billion yuan in 2019, equivalent to 5.1% of the revenue of Midea's consumer electronics sector.

From 2020 to 2022, the revenue of Gree's household appliances sector fell and stagnated, with a revenue of 4.57 billion yuan in 2022, equivalent to 3.6% of Midea's consumer electronics sector's revenue of 125.3 billion yuan (a fraction of 5.3 billion yuan).

After more than a decade of hard work, Gree Life Appliances (including refrigerators) still has revenue hovering at the level of billions, and even the most rudimentary forms of diversification cannot be said to be successful.

Medium and advanced difficulty levels

The intelligent equipment sector includes industrial robots, CNC machine tools, etc. The initial user is Gree itself.

Industrial products include compressors, electric motors, refrigeration accessories, and precision molds. The "job" of this section is mainly engaged in the research and development of household appliances and the manufacturing of retail components. After reaching a certain scale, provide products to external customers.

For Gree, intelligent equipment and industrial products are "moderately difficult" to diversify, while green energy, mobile phones, and chips are "highly difficult" to diversify.

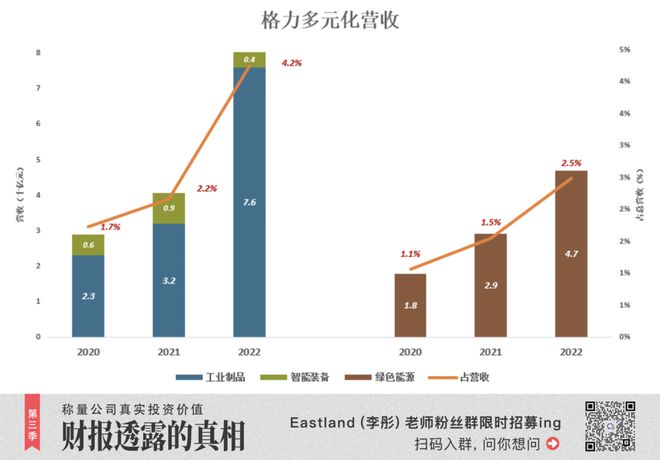

In 2022, Gree's industrial products revenue reached 7.6 billion yuan and intelligent equipment revenue reached 430 million yuan, accounting for a total of 4.2% of the total revenue.

Midea did not dare to play "high difficulty diversification", and its most radical move was to acquire Kuka robots. In 2022, Midea's "Robotics and Automation Systems" segment, corresponding to Gree's "Intelligent Equipment" segment, had a revenue of 29.9 billion yuan, once again losing comparability.

In Gree's "high difficulty diversified" business, only green energy disclosed its revenue separately, with a revenue of 4.7 billion yuan in 2022, accounting for 2.5% of the total revenue.

It is worth noting that in 2022, the revenue from "other businesses" was 35.8 billion yuan, accounting for 19% of the total revenue,The annual report did not disclose details.

In May 2012, Dong Mingzhu replaced Zhu Jianghong as the Chairman of Gree Electric Appliances. In 2012 and 2013, Gree's revenue growth rates were 19.5% and 19.4%, respectively.

In 2022, Gree's revenue reached 189 billion yuan, an increase of 59.3% compared to 2013, with an average annual growth rate of only 5.3%.

Fang Hongbo became the chairman of Midea in 2012, and Midea's revenue increased from 121 billion in 2013 to 343.9 billion in 2022, with an average annual growth of 12.3%.

In 2013, the difference in revenue between Gree and Midea was less than 2 percentage points, and in 2022, it was only 55% of Midea's.

Profitability - still considerable

1) Air conditioning not exceeded

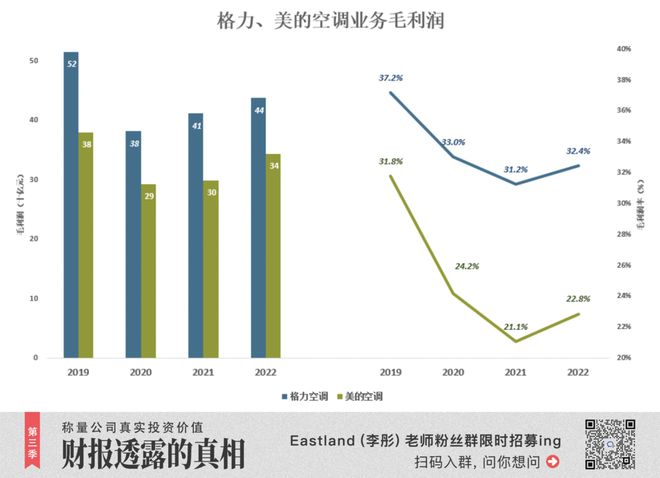

In 2018, Gree Air Conditioning's gross profit reached a peak of 56.8 billion yuan; In 2019, the sales revenue of air conditioners decreased, and the gross profit margin slightly increased to a record high of 37.2%; The gross profit and gross profit margin in 2022 were 43.7 billion and 32.4%, respectively.

Midea's air conditioning sales revenue surpassed Gree in 2020, but its profitability did not reverse and the gross profit margin gap even widened.

In 2019, Midea's gross profit margin was 5.4 percentage points lower than Gree's; In 2022, Midea Air Conditioning earned 9.3 billion less than Gree Air Conditioning, with a 9.6 percentage point difference in gross profit margin.

In terms of profitability, Gree Air Conditioning has not been surpassed.

2) Non air conditioning business

Although Gree Air Conditioning has not fallen behind, the gap between its non air conditioning business and the United States is widening.

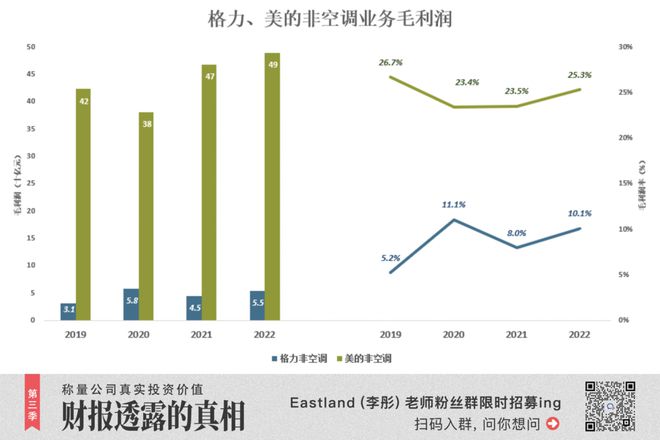

In 2019, Midea's non air conditioning business (including consumer electronics, robotics, etc.) had a total gross profit of 42.3 billion yuan and a gross profit margin of 26.7%; Gree's non air conditioning business (including household appliances, intelligent equipment, and other businesses) has a gross profit of 3.1 billion yuan and a gross profit margin of 5.2%;

In 2020, the gross profit of Gree's non air conditioning business increased to 11.1%, with a gross profit of 5.8 billion yuan, equivalent to 15.3% of Midea.

In 2022, Gree's non air conditioning business had a gross profit of 5.5 billion yuan, equivalent to 11.1% of Midea's, widening the gap once again. The gross profit margin of non air conditioning business is 10.1%, 22.4 percentage points lower than that of air conditioning business.

In 2022, Midea's non air conditioning business had a total gross profit of 4.9 billion yuan and a gross profit margin of 25.3%, which is 2.5 percentage points higher than the air conditioning business.

In 2022, Midea's air conditioning business earned 9.3 billion less than Gree's, while non air conditioning business earned 43.5 billion more than Gree's. Ultimately, Gree earned 34.2 billion less gross profit.

From revenue scale to profitability, Gree's diversification is not as successful as Midea's.

3) Excellent cost control ability

The blue dashed line represents the gross profit margin, and the colored stacked column represents the expense rate. Blue drowns out color, only then can enterprises have operating profits.

Gree's "blue color stands high", with typical characteristics of blue chip stocks, slightly inferior to Meituan:

In 2019, Gree's gross profit margin was 27.6%, with a total of three expenses accounting for 14.1% of revenue, which was 13.5 percentage points lower than the gross profit margin;

In 2022, Gree's gross profit margin decreased to 26%, and the total proportion of the three expenses to revenue decreased to 12.1%, increasing the gap with the gross profit margin to 14 percentage points.

In 2019, Midea's gross profit margin was 28.9%, with three expenses accounting for 19.4% of revenue, 9.5 percentage points lower than the gross profit margin;

In 2022, Midea's gross profit margin decreased to 24.2%, and the total proportion of the three expenses to revenue decreased to 15.4%, with a gap of 8.9 percentage points compared to the gross profit margin.

In 1990, at the age of 36, Dong Mingzhu went south alone and started as a salesperson. With impressive performance, she rose steadily until she was recognized by Gree founder Zhu Jianghong and became the "successor".

Although diversification in trading is not enough, it is widely believed that Dong Mingzhu is at least a marketing expert.

But the refrigerator business did not expand, indicating that Dong Mingzhu is not a marketing expert

Dong Mingzhu's core competency is control. Gree has 90000 employees, with an annual sales scale of nearly 200 billion yuan and distributors throughout the country. Dong Mingzhu manages such a large household business in an orderly manner. Few Chinese and foreign entrepreneurs can achieve this level.

Zhu Jianghong has laid a good foundation, and Dong Mingzhu is a good defender.

During his time in Gree, Meng Yutong often absenteed from work to participate in business activities and engage in private work. Dong Mingzhu has a good way of running a family, and ordinary employees of Gree can try absenteeism once! People around Mr. Dong are often absent from work,Who supports Meng Yutong?

Asset status - slightly lower than that of friends

1) Accounts receivable and inventory

receivable

The phenomenon of distributors being intimidated and lured by home appliance manufacturers to pick up goods in advance or in excess is commonly known as' pressure on goods'. Especially for products like air conditioners, if distributors only pick up goods before the peak season, it is difficult for manufacturers to arrange production.

The goods picked up by the dealer cannot be returned, otherwise the factory cannot confirm revenue.

receivablereceivablereceivablereceivable

receivable

2022receivable/receivable46531%20%

2022receivable/receivable43345%27%

2022receivable/receivable25527%10%

2023receivable40038%##

inventory

inventoryreceivable

The turning point occurred in 2020, clearly due to the impact of the epidemic.

2020inventory294receivable30189%2023inventoryreceivable70%

2019inventoryreceivable21%202284% 2023inventoryreceivable80078%202240%

2023inventoryreceivable56%

receivableinventory

2) Net current assets

Net current assets, also known as "Networking capital", are funds available for use, turnover, and monetization. Graham believes that only when the stock price is below 60% of net working capital per share can there be investment value. Fortunately, this standard is already outdated, otherwise it would be difficult to find investment targets.

Actually,The ratio of net current assets to current liabilities can effectively reflect a company's liquidity risk.

At the end of 2021, Gree, Midea, and Haier's net current assets all fell to the bottom, and Haier even showed negative values.

Midea's rebound was the strongest, with net current assets reaching 54.8 billion at the end of 2022, equivalent to 27% of current liabilities; At the end of the first quarter of 2023, it fell back to 52 billion yuan, accounting for 23% of current liabilities;

Gree's performance is quite stable, with net current assets of 55.5 billion at the end of the first quarter of 2023, accounting for 25% of current liabilities;

Haier is relatively weak, with net current assets of 18.7 billion yuan at the end of the first quarter of 2023, accounting for 16% of current liabilities;

As of the close of March 31, 2023, the stock prices of Gree, Midea, and Haier were 3.7 times, 7.3 times, and 11.5 times the net working capital per share, respectively, far below Graham's standard of 0.6 times.

3) Undistributed profits

The dividend of a listed company comes from the undistributed profits of the parent company (where the parent company refers to the entity of the listed company).

Midea's undistributed profits have steadily increased, reaching 58.4 billion yuan per share in 2018; At the end of 2022, it increased to 119.7 billion yuan per share. The closing price in 2022 is three times the undistributed profit per share.

In 2021, Gree's undistributed profits surged to 66 billion yuan, at 11.7 yuan per share; At the end of 2022, it fell back to 52.3 billion yuan, at 9.3 yuan per share. The closing price in 2022 is 3.4 times the undistributed profit per share.

Haier's undistributed profits are so small that they are not in line with Gree and Midea's drawings. At the end of 2022, the total amount was 5.3 billion yuan, with 0.56 yuan per share. The closing price in 2022 is 43 times the undistributed profit per share.

There were two unexpected findings about Gree's simple 'physical examination':

Firstly, in addition to weak revenue growth and unsuccessful diversification, Gree's profitability is not inferior to Midea, its asset quality is far superior to Haier, and its cost control ability is unmatched;

Secondly, life is difficult for home appliance giants.

*The above analysis is for reference only and does not constitute any investment advice

Tag: Gree Physical Examination Report

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.