NVIDIA CFO Sells Equity: May Indicate Overestimation of Stock Price, "Wood Sister" Says Pricing Ahead

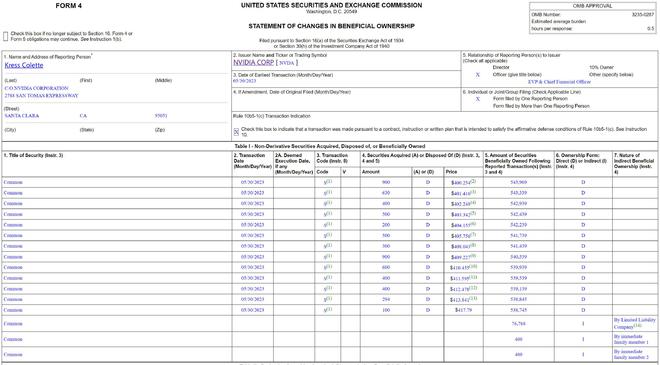

Lei Diwang Lotte June 2ndAt a time when NVIDIA's market value exceeded trillions of dollars, NVIDIA EVP and CFO KressColette continued to sell their company's equity on May 30, 2023 US time.KressColette sold a total of 6124 shares of NVIDIA equity, with an average reduction price of $400

Lei Diwang Lotte June 2nd

At a time when NVIDIA's market value exceeded trillions of dollars, NVIDIA EVP and CFO KressColette continued to sell their company's equity on May 30, 2023 US time.

KressColette sold a total of 6124 shares of NVIDIA equity, with an average reduction price of $400.254 to $417.79, resulting in a total cash out of approximately $2.49 million.

On May 30, 2023, Nvidia's market value broke through trillions of dollars, setting a new high since its listing. As of today's close, NVIDIA's stock price is $397.7 and its market value is $982.319 billion.

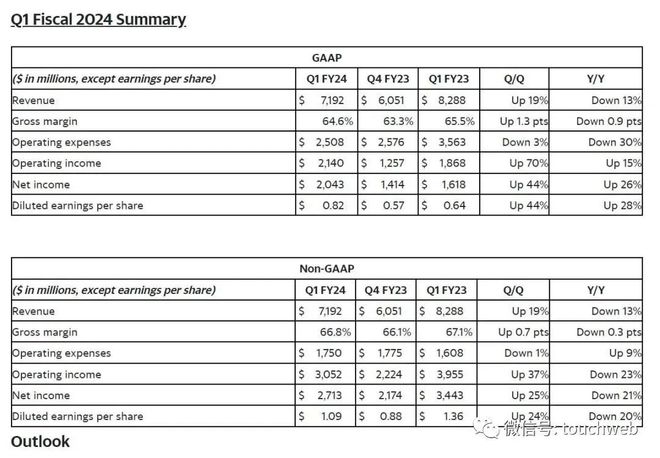

According to the financial report, as of April 30, 2023, Nvidia's revenue was $7.19 billion, a 13% decrease from $8.288 billion in the same period last year and a 19% increase from $6.051 billion in the previous quarter.

As of April 30, 2023, Nvidia's net profit was $2.043 billion, an increase of 44% from $1.414 billion in the previous quarter and a 26% increase from $1.618 billion in the same period last year; NVIDIA's net profit under Non GAAP was $2.713 billion, a decrease of 21% from $3.443 billion in the same period last year and a 25% increase from $2.174 billion in the previous quarter.

Nvidia expects a revenue of $11 billion for the next quarter.

Currently, Nvidia's revenue and profit scale far lags behind Tencent and Alibaba, but its market value is already 2.5 times that of Tencent and 4.62 times that of Alibaba.

As the EVP and CFO of Nvidia, KressColette's reduction in holdings may indicate that the company's stock price is overvalued.

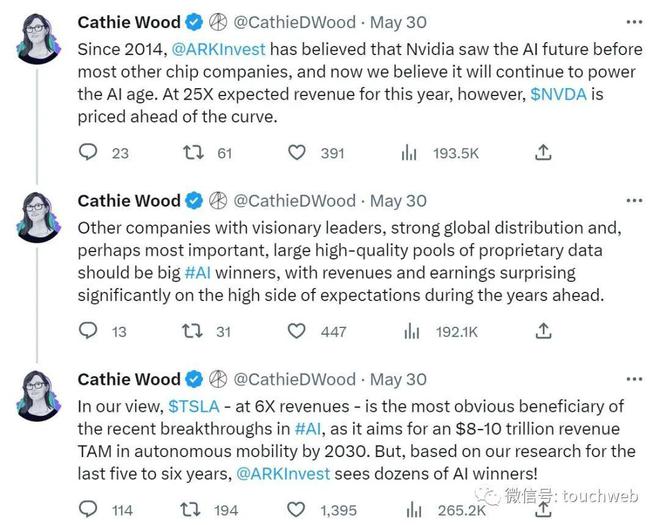

Recently, Cathie Wood, the founder of ARK Investment Management and the "Wood Sister", called NVIDIA, calling the world's highest market value chip manufacturer "pricing ahead". Since 2014, Ark Investment has always believed that Nvidia saw the future of artificial intelligence earlier than most other chip companies, and now we believe it will continue to provide momentum for the era of artificial intelligence. However, based on 25 times the expected revenue this year (market to sales ratio), Nvidia's pricing is still ahead of the curve

Sister Mu may also be defending herself. As Nvidia continued to soar in this round, "Wood Sister" cleared Nvidia's warehouse in advance and missed this round of gains. Since the "Wood Sister" sold off NVIDIA stocks, NVIDIA's market value has increased by approximately $560 billion.

Lei Di was founded by media person Lei Jianping. If reprinted, please specify the source.

Tag: NVIDIA CFO Sells Equity May Indicate Overestimation of Stock

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.